Google faced unprecedented regulatory pressure in 2020 and a financial hit from the pandemic but still managed to pull in $25 billion in profit in the first nine months, on track for another record-breaking year.

The COVID-19 pandemic initially caused advertisers to reduce their budgets, threatening the company’s core business just as American politicians and regulators plotted ways to curtail the company’s power.

In October, the U.S. Department of Justice filed an antitrust lawsuit in the U.S. District Court for the District of Columbia against Google, the most significant use of the Sherman Antitrust Act against a tech company since its 1998 case against Microsoft. Less than two months later, 10 state attorneys general, led by Ken Paxton of Texas, filed a lawsuit in the U.S. District Court for the Eastern District of Texas alleging additional violations of state and federal antitrust laws and calling for a jury trial. And the next day, attorneys general from 38 states, territories, and Washington, D.C., led by Colorado, Iowa, Nebraska, and Tennessee, filed another antitrust lawsuit against Google in the U.S. District Court for the District of Columbia.

In response to the suit filed in Texas, Julie McAlister told The New York Times, “Attorney General Paxton’s ad tech claims are meritless, yet he’s gone ahead in spite of all the facts. We will strongly defend ourselves from his baseless claims in court.” And Adam Cohen, Google’s director of economic policy, responded the next day in a blog post to the states’ suit filed in D.C., saying that the “lawsuit seeks to redesign Search in ways that would deprive Americans of helpful information and hurt businesses’ ability to connect directly with customers.”

Federal lawmakers also acted. Legislators brought Alphabet CEO Sundar Pichai (along with other big tech CEOs) to testify before Congress in contentious hearings and issued a strongly worded bipartisan report calling for more rigorous antitrust oversight from regulators and Congress.

And yet, by the end of the year, parent company Alphabet was beating Wall Street’s predictions and raking in profits again. While the pandemic led to a scary second quarter and just $7 billion in profits, Alphabet posted record revenues and $11.2 billion in profits in October. In January 2020, Alphabet had become the fourth company in history to hit a $1 trillion market value. And by December 2020, it was worth $1.19 trillion.

Here were some of Google’s most memorable moments in a highly memorable 2020.

Antitrust Regulators Woke Up to Big Tech, and Google Was Their Primary Target

Does Silicon Valley have too much unchecked power? Antitrust regulators, who have taken a light-touch approach to the tech industry for decades, became considerably more aggressive in 2020. Their first big swing was at Google.

In February, the Federal Trade Commission announced a review of past acquisitions by several tech companies, including Alphabet, Google’s parent company, which owns a slate of properties, including YouTube, Waze, and Motorola, for anticompetitive impact.

Tech CEOs Face Aggressive Questioning at Congressional Antitrust Hearing

Lawmakers allege abuse of monopoly power and political bias

In July, the House Judiciary subcommittee on antitrust summoned Pichai, along with Amazon CEO Jeff Bezos, Apple CEO Tim Cook, and Facebook CEO Mark Zuckerberg, to testify. Democrats and Republicans alike hammered Pichai with questions spanning Google’s ad dominance to its work in China. The subcommittee subsequently released a lengthy report recommending that Congress and regulators step up antitrust enforcement. Alleging that Google “maintained its monopoly over general search through a series of anticompetitive tactics,” the report said the company “increasingly functions as an ecosystem of interlocking monopolies.”

Soon afterward, the U.S. Department of Justice filed a lawsuit alleging Google’s dominance in search and advertising had led to antitrust violations. Google senior vice president of global affairs Kent Walker called the lawsuit “deeply flawed.” Then in December, the Federal Trade Commission ordered nine tech companies, including Google, to disclose information about how they use people’s data, and two lawsuits brought by state attorneys general accused Google of anticompetitive abuse.

Meanwhile, Google’s $2.1 billion acquisition of the health tracking company Fitbit, announced at the end of 2019, is still pending as European regulators review the deal.

Antitrust regulators have historically been more aggressive in Europe, and scrutiny continued in 2020. However, European regulators have struggled to meaningfully restore competition against Google. In January, Google began auctioning off spots for the default search engine menu on Android phones in the E.U.—a response to a $5 billion fine from the European Commission for abusing its dominant control of the Android operating system in order to promote its search engine. One prominent Google critic, competitor DuckDuckGo (disclosure: DuckDuckGo has donated to The Markup), said the remedy is actually making things worse.

Google the Giant

How to Stop Google Self-Preferencing? Europe May Not Be the Model

A congressional subcommittee last week recommended new nondiscrimination rules for big tech firms, but experts say the trick is enforcement

The Commission has been responsible for the most severe antitrust penalties levied against Google to date: three multibillion-dollar fines since 2017. In February, Google appealed all three at the General Court in Luxembourg. If it loses, it has one more shot, in the European Court of Justice.

In December, the Commission proposed new rules that will introduce additional oversight and higher penalties for anti-competitive behavior by tech platforms, including fines of as much as 10 percent of worldwide revenue and forced breakups for repeat offenders. If adopted, these rules would significantly strengthen the commission’s ability to regulate Google.

Google also faced legal challenges from competitors. Sonos, the wireless speaker company, has become a thorn in Google’s side with a lawsuit alleging theft of its technology. And Epic Games provoked Apple and Google into removing its popular game Fortnite from their app stores in August by selling its in-app currency directly and subverting their platform fees. The company then filed a lawsuit in the U.S. District Court for the Northern District of California alleging antitrust violations that is seen as “a potentially landmark battle” in tech antitrust, according to Bloomberg. Apple and Google have countersued.

Trouble at Home

Some of the company’s strongest criticism comes from within. Google employee and shareholder activism has noticeably increased over the past three years, and in some cases, Google has responded.

The year started with the prominent departure of Alphabet’s chief legal counsel David Drummond following accusations of sexual misconduct. In September, Alphabet’s board settled a lawsuit over its alleged mishandling of sexual misconduct allegations against Drummond and others. Under the settlement, the company agreed to spend $310 million on “workplace initiatives” to make Alphabet more inclusive for employees from underrepresented groups and ended mandatory arbitration for “harassment, discrimination, and retaliation disputes” at all its subsidiaries, enabling people to sue in those situations. In December, the National Labor Relations Board filed a complaint against Google alleging that the company wrongly punished Laurence Berland and Kathryn Spiers for exercising their rights under labor law. Berland was advocating for employees to have more influence over issues including hate speech on YouTube, while Spiers was trying to unionize her team. Google spokesperson Jennifer Rodstrom told The New York Times that Google will fight the charge.

That very same day, Google terminated Timnit Gebru, a prominent Black researcher known for exposing bias in systems built around machine learning. Gebru, whose team at Google was tasked with “ensuring that AI is deployed in ethical and fair ways,” spoke out after a Google manager asked her to retract or take her name off a research paper on ethical challenges in natural language processing. Gebru criticized the company’s lack of progress on diversity goals and cited the rejection of her paper as an example of “silencing marginalized voices.” She says she was fired; her supervisor, Jeff Dean, says she resigned. More than 2,000 Google employees and more than 4,000 supporters outside the company signed a supportive petition, posted on the blog used to organize previous Google walkouts. Pichai emailed employees saying Google will “review the circumstances that led up to Dr. Gebru’s departure.”

The Pandemic Challenged Google, but Ultimately, Revenue Grew

The pandemic presented new challenges for Google, including an increased reliance on automated content moderation as it adjusted to having so many workers out of the office. Google temporarily froze business reviews, restricted coronavirus-related ads, and banned pandemic-related misinformation on YouTube. Still, one “Plandemic” COVID-19 conspiracy theory video reached 7.1 million views on YouTube before it was removed. Then, a contentious presidential election brought a surge of political misinformation that YouTube scrambled to police. In December, YouTube announced it will remove videos that allege widespread errors or fraud in the presidential results.

The BreakdownCoronavirus

What Ever Happened to Those Coronavirus Contact Tracing Apps?

Adoption’s been slow—but stay tuned

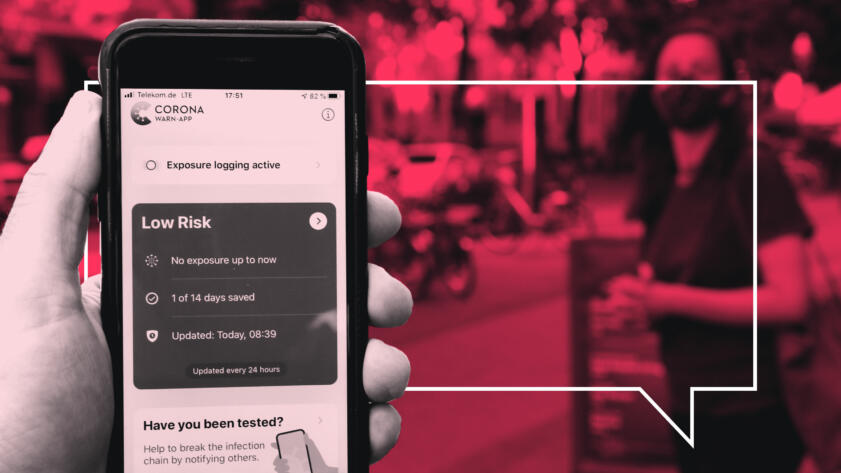

Meanwhile, Verily, Alphabet’s life sciences subsidiary, looked to become a pandemic resource, launching a minimal website in March to help people in California get tested for COVID-19. It reached capacity within hours. Verily expanded its program, but in October the counties that include Oakland and San Francisco announced they were dropping the program due to privacy concerns and lack of penetration in low-income communities. Google and Apple rolled out a feature in iPhone and Android phones that allowed for privacy-protecting contact tracing, but adoption has been lackluster.

Financially, it looked earlier in the year as if Google might take a big hit. The company is heavily dependent on advertising, and travel companies are some of its biggest customers. When the pandemic first hit, Alphabet announced it would pull back on hiring and posted a year-over-year decrease in advertising revenue for the first time in its history. But by October, Google had reversed its slide. Alphabet beat analyst expectations in the third quarter, posting a 14 percent growth in revenue over last year. “While we’re pleased with our performance in the third quarter, there is obviously uncertainty in the external environment,” Ruth Porat, Google’s chief financial officer, said on a call with investors.

Update

This story has been updated to include information on a lawsuit filed against Google by state attorneys general on Dec. 17, 2020.