Looking for housing is always stressful. The market moves fast, application fees can be high, and it can feel as if there are fewer good housing options than people trying to snatch them up. Being rejected by the landlord of your dream home because of criminal records or evictions that aren’t yours? Well, that’s even worse.

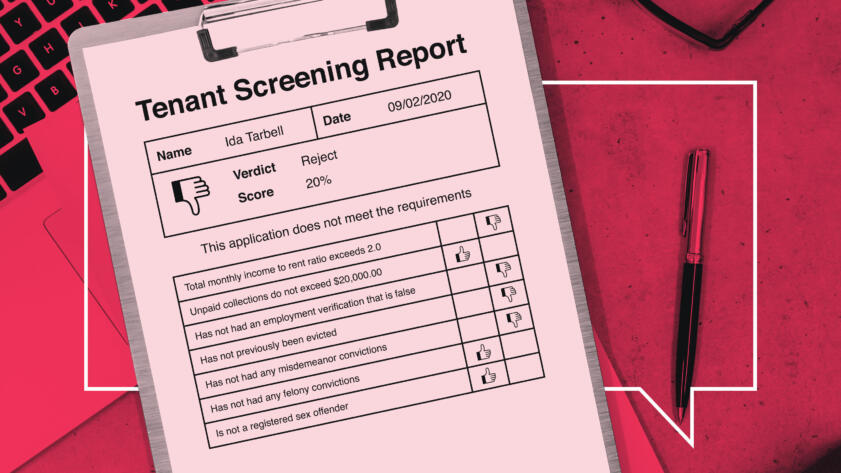

Tenant screening reports are often generated in seconds by automated matching algorithms that sort through public record data from many different sources—like criminal records, sex offender lists, eviction filings, credit bureaus, and even terror watch lists. An investigation into these reports by The Markup and The New York Times published today shows that not only is the underlying data often outdated and incomplete, but sloppy data-matching methods can also sweep in negative information about the wrong people.

If you think this has happened to you, you have some options. We created this FAQ as a guide.

I applied for an apartment and didn’t get it. How do I know if it was because of a negative background check?

Landlords are required by a federal law, The Fair Credit Reporting Act, to let you know if a negative background check was part of the reason they rejected you, and where to go to dispute it if you need to. Some landlords may not know this, though, so you should always ask.

A screening company’s report about me includes information that is wrong. How do I fix it and get the rental I want?

Time is not your friend here. Screening companies have 30 days to reinvestigate after you ask them to and to fix errors. They can certainly do it more quickly, but if it does take a month, the landlord may have given the unit to someone else by then. Still, it may be worth it to you to go through the dispute process with the screening company anyway, because the landlord may have another unit available—or another landlord may use the same screening company.

The process boils down to this: Get the report from the screening company and dispute it. (Details below.)

How do I get a copy of the screening report the landlord got about me?

Start with the landlord. She or he might say no—landlords aren’t legally required by law to show you the report itself.

But landlords are required to tell you the name of the screening company they used and the company’s contact info, in what’s called an “adverse action notice.”

Those screening companies are then required by law to send you a free report if you’ve been turned down because of it. Keep in mind that they usually run the reports instantly, so what you get may not be the exact same one the landlord got.

A screening company reported someone else’s crimes or evictions on my record. How do I fix it?

Contact the screening company directly and ask to see your report and dispute it. They’ll probably want you to send in a copy of your ID or other documents first, to prove you are who you say you are.

Screening companies have 30 days by law to reinvestigate and let you know the result. Keep copies of all of your documents, and any correspondence you have with the company. If you speak to someone over the phone, take notes.

If the company agrees that the information on the report isn’t yours, ask the company to immediately send a corrected report to the landlord. Even if the rental you originally wanted is taken by that point, he or she may have another one for you to check out, which will save you from having to start over with another landlord.

I’m trying to get into public housing or sign up for a housing voucher, but I was denied because of an incorrect background check. What can I do?

If you’ve been denied access to a low-cost unit or a subsidized voucher because of an incorrect screening report, you are entitled to a separate “grievance process” with the housing authority itself. If this happens to you, you should:

- Act fast—you’ll only have 10 days after getting rejected to challenge the decision. Call the public housing authority telephone number listed on your denial letter (which typically comes to you in the mail) and ask for a grievance hearing.

- Prepare. At the grievance hearing, you’ll want to have documentation of your identity, your previous addresses and any other evidence you need.

- Contact a pro bono or low-cost attorney. You’ll probably have better luck at the grievance hearing if you bring an attorney. Look for a free legal aid organization in your area, and ask for someone who specializes in housing. Many have hotlines you can call.

All kinds of background companies are reporting WRONG information about me! How do I fix it?

Bad news: There is no one-stop shop that can fix a bad record or bad match across the industry. According to estimates, about 2,000 background screening companies operate in the U.S. You have to dispute each incorrect report with each company.

It’s not fair that I have to jump through all these hoops because the screening company got it wrong. Where can I file a complaint?

You have two options, besides complaining to the background screening company itself: You can complain to an oversight agency, or you can take the screening company to court.

The easier option is to complain to an agency.

The Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) share oversight of the consumer reporting industry, which includes tenant screening companies. They can take the companies to court and hit them with fines for breaking the law. The FTC fined RealPage $3 million in 2018.

Both agencies have complaint portals on their websites. (The FTC’s is here, and the CFPB’s is here.) You can complain about the erroneous report, how the company handled your dispute, or both. The CFPB’s complaint database is public, so you can see what other people have written, too.

State attorneys general also have oversight authority for consumer complaints. The details on how to file complaints with those offices vary state by state. You can find contact information for your state’s attorney general here.

Your other option is to sue the background screening company if you believe it has violated the federal Fair Credit Reporting Act—for instance, if it has failed to “follow reasonable procedures to assure maximum possible accuracy.”

Look for an attorney who specializes in consumer law or credit reporting issues. You can find them online or call a national organization like the National Association of Consumer Advocates (NACA), which can connect you to a local lawyer who can explain your options.

This is crazy. Isn’t there anything I can do BEFORE applying for housing to prevent this from happening in the first place?

Not much, unfortunately. Under the current system, there’s no way to guarantee that a background screening company won’t report information that isn’t yours, particularly mismatched or incomplete criminal, eviction, and even traffic records (which are sometimes misreported as criminal records).

You can do a few things to combat some other errors. For instance, if you’re planning to rent a new place in the near future, the Federal Trade Commission recommends that you get a copy of your credit report (through Annualcreditreport.com) and look it over to make sure it doesn’t include any mistakes or evidence of identity theft. Your credit report is only part of the screening, but it is an important one.

The FTC’s guide also recommends that you show the landlord any documentation you may have about your previous court cases if they’ve been resolved or dismissed. That could reduce the likelihood that the landlord will reject you for out-of-date reports, but it won’t guarantee it.