When you hit the checkout line at your local supermarket and give the cashier your phone number or loyalty card, you are handing over a valuable treasure trove of data that may not be limited to the items in your shopping cart. Many grocers systematically infer information about you from your purchases and “enrich” the personal information you provide with additional data from third-party brokers, potentially including your race, ethnicity, age, finances, employment, and online activities. Some of them even track your precise movements in stores. They then analyze all this data about you and sell it to consumer brands eager to use it to precisely target you with advertising and otherwise improve their sales efforts.

Leveraging customer data this way has become a crucial growth area for top supermarket chain Kroger and other retailers over the past few years, offering much higher margins than milk and eggs. And Kroger may be about to get millions of households bigger.

In October 2022, Kroger and another top supermarket chain, Albertsons, announced plans for a $24.6 billion merger that would combine the top two supermarket chains in the U.S., creating stiff competition for Walmart, the overall top seller of groceries. U.S. regulators and members of Congress are scrutinizing the deal, including by examining its potential to erode privacy: Kroger has carefully grown two “alternative profit business” units that monetize customer information, expected by Kroger to yield more than $1 billion in “profits opportunity.” Folding Albertsons into Kroger will potentially add tens of millions of additional households to this data pool, netting half the households in America as customers.

While Kroger is certainly not the only large retailer collecting and monetizing shopper data through the use of loyalty programs, the company’s evolution from a traditional grocery business to a digitally sophisticated retailer with its own data science unit sets it apart from its larger competitors like Walmart, which also collects, analyzes and monetizes shopper data for brands and for targeted advertising on its own retail ad network.

“I think the average consumer thinks of a loyalty program as a way to save a few dollars on groceries each week. They’re not thinking about how their data is going to be funneled into this huge ecosystem with analytics and targeted advertising and tracking,” said John Davisson, director of litigation at Electronic Privacy Information Center (EPIC) in an interview with The Markup. Davisson added, “And I also think that’s by design.”

Kroger did not respond to multiple requests for comment. Albertsons Companies’ vice president of communications Daphne Avila told The Markup in an emailed statement: “At Albertsons Companies, we appreciate the importance of privacy and take appropriate handling of our customers’ data seriously. We recently updated our Privacy Policy so customers can clearly understand our approach to privacy and the policies that we have put in place to protect their information.”

Walmart did not respond to a request for comment.

What Data Does Kroger Collect, and How?

As a Kroger shopper, your information can be collected both online and in person in their stores.

When you enter a store: If you have a Kroger app on your phone, Bluetooth beacons may ping the app to record your presence and may send you personalized offers. Your location within the store can be tracked as well. (Kroger says your consent is required and the location tracking stops when you leave.) Kroger also says that in “select locations” store cameras are collecting facial recognition data (this is indicated with signs noting the use of the technology.)

At the register: If you use your loyalty membership (such as Kroger Plus or Boost), detailed information about your purchases gets added to your shopping history, tied to a unique household identifier.

If you are shopping online at Kroger.com: Third-party trackers send your product page views, search terms, and items that you have added to your shopping cart to Meta, Google, Bing, Pinterest, and Snapchat.

According to the Kroger privacy policy, the company will “only collect information when needed for a particular purpose.” Here is some of the information that the company says it may collect, depending on the specific customer:

- Personal information: Information you provide when you sign up for the loyalty program: name, email address, mailing address, phone number, membership ID, and unique household identifier

- Purchase history: Historical in-store and online shopping purchases (with no time limits on how long the information is kept while you are a member)

- Location: Your precise physical location in the store (with your consent), including when you enter and leave a store (Kroger app, GPS, and Bluetooth beacons inside stores)

- Financial and payment information: “credit, debit, or other payment card numbers, bank account numbers”

- Health-related information: “Where permitted by applicable law, to serve you better we may make certain inferences about you based upon your shopping history that are health related”

- Mobile device data: Mobile advertising ID, IP address, browsing data, use of tracking pixels, and cookies

- Demographic data: “age, marital or family status (including whether your family includes children), languages spoken, education information, gender, ethnicity and race, employment information, or other demographic information”

- Biometric data: Facial recognition (in select locations, with signs providing notice)

- Behavioral inferences: “We create inferred and derived data elements by analyzing your shopping history in combination with other information we have collected about you to personalize product offerings, your shopping experience, marketing messages and promotional offers”

The company says in its privacy policy that the data collection is used to fulfill shopper requests, personalize product offerings, improve services, and “support our business operations and functions.” Kroger notes in disclosures to the Securities and Exchange Commission that “[t]hird-party entities do not have access to identifiable customer data.”

A Look at 84.51, Kroger’s Data Company

Founded in Cincinnati in 1883, Kroger counts 60 million households in the U.S. as regular shoppers at 2,750 stores under the nearly two dozen retail brands that it owns and operates (including Ralphs and Food 4 Less). The chain has stores in 35 states and the District of Columbia and had annual sales of more than $137 billion in 2021. Kroger noted in a promotional presentation highlighting the potential benefits of the merger that its “alternative profit businesses”—which include financial services (Kroger Personal Finance), retail advertising (Kroger Precision Marketing), and retail data operations (84.51)—could generate $1 billion in profits per year for investors, though in 2021 the company reported that “alternative profits” contributed “an incremental $150 million of operating profit.”

In 2003, Kroger partnered with Dunnhumby, a data science subsidiary of U.K. supermarket chain Tesco. Dunnhumby was an early innovator in the gathering of shopper data through loyalty programs. After a successful 12-year partnership, Kroger purchased a majority stake in Dunnhumby’s U.S. operations and rolled it into its own data science firm called 84.51, named after the longitude of Kroger’s Cincinnati headquarters.

84.51 is considered a leader in the industry, selling insights to makers of the products sold in stores like Kroger’s. The company’s clients include more than 1,400 companies, including General Mills, Unilever, CocaCola, and Kraft Heinz. The data 84.51 provides to them is used to understand not just what the sales figures are for a given product but also the context of the purchase—context that can only be understood with data about the shopper.

Phil Lempert is the founder and editor of Supermarket Guru and studies trends in the retail grocery business. In an interview with The Markup, Lempert said the type of data that 84.51 sells can answer questions about a particular product: “What is it … that makes a consumer buy it? Is it just price, is it something else? It gives [brands] a road map on how to compete effectively, whether it’s against store brands or competing brands to understand that consumer behavior.”

2,000 Shopper Variables

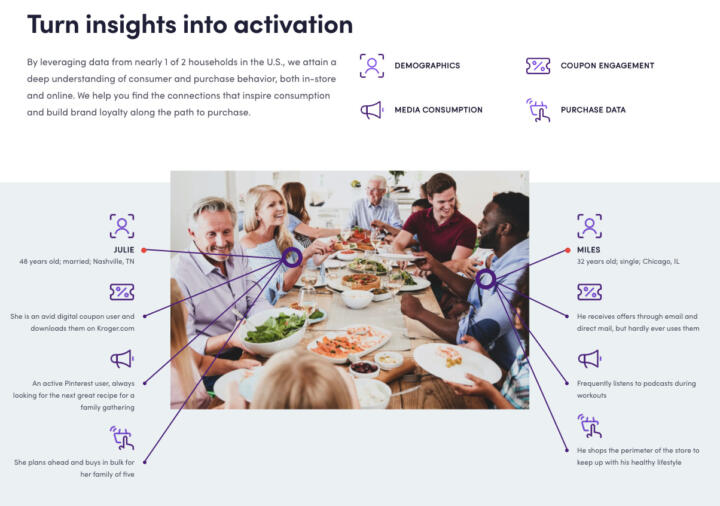

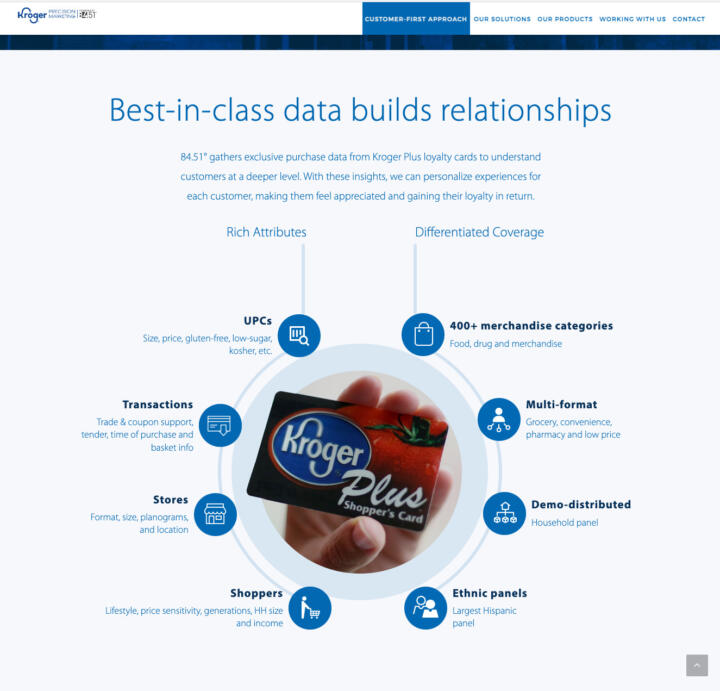

On its website and marketing materials, 84.51 advertises both the scale and granularity of its data.

“We have collected over 2,000 variables on customers,” claims an 84.51 marketing brochure titled “Taking the Guesswork Out of Audience Targeting.” The historical reach of the data is another selling point, noting that the data includes 18 years of Kroger Plus card data. A page marketing 84.51’s “Collaborative Cloud” says the company has “unaggregated” data about individual product sales “from 2 billion annual transactions across 60 million households with a persistent household identifier.” It adds that this data is “privacy compliant.”

84.51 highlights the broad insights it has gleaned from its shopper data on its marketing pages. A graphic on Kroger Precision Marketing’s website highlights “Ethnic panels (Largest Hispanic panel),” product attributes such as low-sugar and kosher foods, and shopper attributes such as “Lifestyle, price sensitivity, generations, [Household] size and income.”

On a webpage promoting “behavioral analytics,” 84.51 claims “35+ petabytes of first-party customer data, our science—no crystal ball needed.” A petabyte is equal to one million gigabytes. For comparison, Kroger’s trove of customer data is 66 percent larger than the U.S. Library of Congress’s digital collection, which clocked in at 21 petabytes for 2022.

Albertsons’ Avila told The Markup that the company restricts some categories of ad segmentation, stating, “… we do not use groupings related to age, race, gender, ethnicity, income levels or financial status to create customer groups for either our own or third-party promotions.”

How Is Shopper Data Used?

Selling Shopper Insights

Experts told The Markup that companies that sell products in grocery stores don’t have much visibility into what happens after their items are placed on shelves. These brands want granular shopping data that only supermarkets have in order to gauge the success of the brands’ products. In recent years, this data has become harder to come by and therefore more valuable.

35+

petabytes of first-party customer analytics data collected by 84.51

Source: 8451.com

“We’re in a situation now that we’re calling ‘data deprecation,’ ” said Mary Pilecki, an analyst at the market research firm Forrester who studies retail loyalty programs. “Privacy laws have increased globally. There are firms like Apple who are blocking ad tracking software, and of course Google keeps promising that the third-party cookie will go away.” Pilecki said this industry-wide scarcity of high-quality first-party data has left firms scrambling for new suppliers. “Companies are now saying, whoa what do I do? I’m not gonna have this data. Well, loyalty programs are actually a great way to collect this data.”

Targeted Advertising

For supermarkets, collecting intelligence on shoppers is useful not just for selling back to brands but also to enable highly targeted advertising to reach specific shoppers. According to Forrester, retailers and marketplaces were estimated to sell $40 billion in digital ads in 2022, with an expectation of that figure doubling in four years.

Both Kroger and Albertsons run their own retail ad networks, which provide a way for advertisers to deliver ads to specific targeted segments of their shoppers, optimizing their ad spending. Kroger Precision Marketing (Kroger’s ad network) markets itself to brands and advertisers with the promise of reaching their shoppers via email, digital coupons, apps, online search, influencers, in stores, and even on shoppers’ televisions. For example, the streaming platform Roku launched a partnership with Kroger in 2020 to make “TV advertising more precise and measurable” using Kroger’s data.

One case study on 84.51’s website describes how a snack brand used the company’s data to measure the effect of ads it placed on Roku’s connected TVs. The analysis showed that households that saw the snack ads spent five times more on the brand than the average Kroger shopper.

For Albertsons’ part, Avila told The Markup that while the company does have “revenue share agreements in place with retail analytics groups,” the company says it takes steps to ensure shopper privacy. “Importantly, we always ensure that customer information we share is de-identified and aggregated, in accordance with our publicly disclosed policy.”

There is at least one piece of evidence that Kroger has been sensitive to clueing shoppers in to its ability to target them this way. A marketing document linked to from Kroger’s website spells out the rules for advertisers participating in Kroger’s retail ad network. Under a section describing the “Tone of voice” to use in Kroger ads, the document notes, “Avoid copy that assumes customer can be identified by: lifestyle, activities, demographics, or gender.”

Regulatory Scrutiny

Kroger’s merger with Albertsons has shined a spotlight on its data collection. While regulators at the Federal Trade Commission are reviewing the proposed deal, lawmakers in Congress have made the companies’ data operations a focus of attention, albeit one that has taken a back seat to concerns about competition, food prices, and the impact of the merger on employees. At a November Senate subcommittee hearing about the merger, Sen. Mike Lee (R-UT) asked if Americans “really need a grocery store chain with wealthy owners who collect more of their personal data.”

Sen. Marsha Blackburn (R-TN) asked Kroger CEO Rodney McMullen, in a letter following up on the hearing, how the combined companies would collect data. McMullen responded, “Our combined customer insights enable us to deliver more personalized promotion strategies, saving customers time and money.”

This situation is especially concerning given how few options consumers have for grocery stores in many communities.

Sen. Amy Klobuchar

A witness at the hearing, Consumer Reports’ senior researcher Sumit Sharma, disagreed that the merger would provide any obvious new benefit in personalizing the shopping experience for consumers. “The difference seems to be that a combined Kroger Albertson will be able to analyze data from approx. 85 million households post-merger rather than 60 million households pre-merger. No evidence is presented to suggest that the ability to analyze data on an additional 25 million households would materially improve capabilities to personalize experiences,” he stated in his written response for the record, answering a question from Sen. Thom Tillis (R-NC).

Sen. Amy Klobuchar (D-MN), chair of the Subcommittee on Competition Policy, Antitrust, and Consumer Rights, told The Markup in an emailed statement, “Most people have no idea that some stores are collecting data on what groceries they buy to sell to the highest bidder or using facial recognition technology to track them as they shop. This situation is especially concerning given how few options consumers have for grocery stores in many communities. Americans deserve protections against excessive surveillance and companies misusing their personal data. It’s time to pass federal privacy legislation to protect consumers.”

Privacy Concerns

Understanding the Value Exchange

Kroger’s loyalty programs are extremely popular with shoppers. The company says that 96 percent of all purchases at its stores are tied to a loyalty card. For shoppers, the loyalty program appears to offer a simple, worthwhile bargain: In exchange for your shopping data, the store will give you significant benefits in the form of discounted prices, coupons, fuel discounts, and a personalized shopping experience.

“What isn’t necessarily disclosed,” said Stephanie Liu, an analyst at Forrester who researches consumer privacy, “is that it is not just tracking what you buy, it’s building audiences and segments off of that,” or in other words, bundling you with other shoppers based on a shared behavior, demographics, or inferred interests. Advertisers can then target these groups.

“Yes—you’re getting discounts, but the number of parties involved who are accessing your shopper data grows exponentially,” said Liu. Kroger’s privacy policy does not disclose how many companies Kroger shares data with.

Albertsons’ Avila told The Markup, “We have made significant efforts to be transparent about how we use customer information.” Avila added, “We understand the importance of privacy and take steps, such as the anonymizing and aggregation of potentially sensitive demographic information, to protect our customers’ privacy.”

Sensitive and Unique Data

While Kroger and Albertsons stress that they only share “de-identified” or aggregated shopper data, research has shown that the unique combinations of things we purchase, and the time and place of those purchases, can be as re-identifiable as mobile phone location data. A 2015 MIT study found that in a large set of anonymous shopping data, 90 percent of shoppers could be re-identified using as few as four purchases with a known price, purchase date, and store location.

As supermarkets expand the variety of goods they sell to include health care and medical products, sensitive information about our lives, relationships, and finances can be gleaned by the patterns of what we buy there.

“So I look at your shopping cart and I can tell if you’re a carnivore, if you’re vegan, if you like ethnic foods, if you only buy kosher foods,” said Supermarket Guru’s Lempert.

“You can infer if you’re a parent and what stage of parenthood you’re at depending on what size diapers you’re buying,” Forrester’s Liu said. “You can infer race, gender, and generation. And the kicker though is you can confirm a lot of that when you compare this data with third-party data.”

Shopping for sensitive items on Kroger’s website highlights another privacy concern.

A Markup analysis of browsing and shopping for a pregnancy test on Kroger.com showed that searching for the product, viewing an individual product page, and adding the item to the cart all activated trackers that transmitted the product name and a user ID to Meta, Google, Pinterest, Snapchat, and Bing, among other companies.

What Can You Do About It?

Thanks to various state privacy laws, residents of California, Nevada, and Virginia can opt out of data sales but still remain a member of Kroger’s loyalty program and continue to receive discounts. You can request to opt out here. California and Virginia residents can also request a copy of their data, and request that their data be deleted.

Some grocery chains like Trader Joe’s choose not to offer loyalty programs and say that they do not sell shopper data. Trader Joe’s website notes “… we don’t have sales, we don’t offer coupons, and there are no loyalty programs or membership cards to swipe at our stores. Trader Joe’s believes every customer should have access to the best prices on the best products every day.” In a recent episode of the grocery chain’s podcast, a company spokesperson said, “We don’t collect any data on our customers.”

EPIC’s Davisson said regulators can play a role by forcing companies like Kroger “to minimize [the] collection, retention, transfer and use of … data to what is reasonably necessary to serve the consumer.”

Lempert suggests that there may not be much you can do as an individual if you want to avoid being tracked. “I would just say that if you’re concerned about privacy and a supermarket or any retail store being able to sell your data, don’t sign up for the frequent shopper card and pay with cash.”