Hello!

Welcome to The Markup newsletter. We wanted you to be the first to know that we have just launched a sparkling, new website and started publishing! We’ll be sending you emails once a week from here on out. 🙂

You may have seen coverage of our launch in The New York Times. Or maybe you spotted our billboard in the SF Mission district? Yeah, we’re obviously very excited about finally going live!

The Markup is all about holding accountable the technology that powers our lives. So, for our first story we investigated an algorithm that sets prices for a product you need for everyday life and you MUST purchase or you can land in jail – car insurance.

When most people think big tech, they don’t think about car insurance. But the insurance industry pioneered big data and algorithmic predictions long before anyone in Silicon Valley. And when it comes to algorithms that matter, car insurance is a big one. Drivers are legally required to have car insurance in virtually every state. For many people, not being able to drive means you can’t work, take your kids to school or go to the doctor.

Car insurance algorithms are supposed to set prices based on how risky a driver you are. But we found that Allstate has been calculating prices with a secret algorithm that appears to let prices float higher if you’re unlikely to shop around for a better deal. Allstate calls it a customer “retention model.”

When we dug into the algorithm we found that it was essentially a suckers list that squeezed customers who were already paying the most.

And surprise, surprise, some groups were more likely to be deemed suckers than others. Those who would have received massive rate hikes under Allstate’s plan were disproportionately middle-aged (41-62), disproportionately male, and disproportionately living in communities that were more than 75 percent “nonwhite,” according to census data.

Allstate has countered that our work is “inaccurate and misleading” because the ratings plan that we analyzed never went into effect. It was ultimately rejected by Maryland as “unfairly discriminatory.” But Allstate declined to tell us why our findings are not relevant for the ten states that have approved its ratings plans that mention using a retention model: Arizona, Arkansas, Illinois, Iowa, Michigan, Missouri, Nebraska, Oklahoma, Tennessee, and Wisconsin.

––

To report this story—and others you’ll see on our website soon—we use an approach rooted in the scientific method that we are calling The Markup Method:

Build. We ask questions and collect or build the datasets we need to test our hypotheses.

Bulletproof. We bulletproof our stories through a unique review process, inviting external experts and even the subjects of investigations to challenge our findings.

Show our work. We share our research methods by publishing our datasets and our code. And we explain our approach in detailed methodological write-ups.

In the case of our Allstate investigation, when we found that that Allstate had been pushing an algorithm that sets prices based on how likely you are to shop around, the first thing we did was build a dataset.

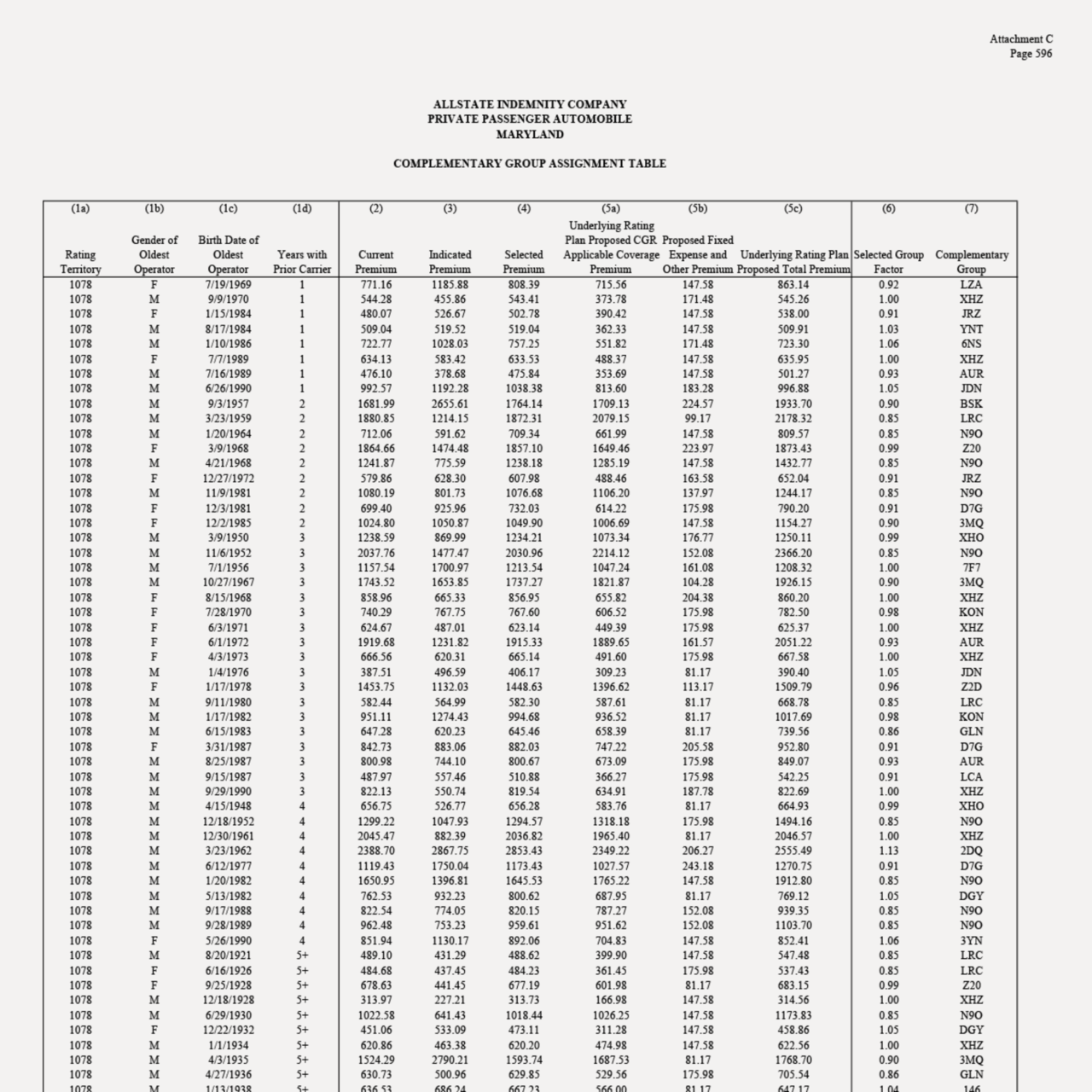

Investigative Data Journalist Maddy Varner and Investigative Reporter Aaron Sankin reviewed tens of thousands of pages of insurance filings before they found a document that detailed how the algorithm would affect every single Allstate customer in the state of Maryland—all 93,000 of them. The table was 1,101 pages long.

Working with the team at Consumer Reports, they joined Allstate’s data with census data. Then they ran statistical tests to try to understand how the model worked and whether certain groups of people were being disproportionately affected.

Next, they worked to bulletproof their findings. They worked with the statistics team at Consumer Reports and sent their data, code and methodology for outside review to statisticians and insurance industry experts.

They also sent their data, code and methodology to Allstate. Allstate declined to answer any of their detailed questions and did not raise any specific issues with our statistical analysis.

Finally, as part of our Show our Work approach, they published the data, code and statistical methodology to accompany our article.

––

As algorithms and technology increase their reach into our everyday lives, we believe that this type of data-driven statistically sophisticated journalism is vital. Without it, people are left in the dark, unable to understand and make decisions about the technology that is being used to automate decision-making across all industries.

Because, rest assured, Allstate’s algorithm will not be the last to attempt to set prices based on your behavior without you even knowing it. And the question we all have to ask as a society is: under what conditions are we willing to accept that?

As Daniel Schwarcz, a professor at University of Minnesota Law School who studies pricing discrimination, said when we interviewed him: “Is it O.K. to charge more to that person because they don’t have the resources or time or attention to invest in shopping?”

These are the questions we are determined to investigate. Thanks for reading and for joining us on this journey!

Best

Julia Angwin

Editor-in-Chief and Founder

The Markup