Hello, friends,

We’ve increasingly come to see that the internet is not just a democratizer of information and speech but also a place that reaffirms the inequities and power dynamics of the world in disturbing ways.

One example is how it enables more aggressive practices by debt collectors. Collectors can track down their targets online and even contact them directly through social media.

And while borrowers have long been able to dispute or restructure those debts in small claims court, that recourse is also being transformed online. Some states are essentially turning small claims courts into online chatrooms—which can come with poor results for defendants.

Last week, The Markup reporter Todd Feathers reported on how Utah’s move to online dispute resolution has benefited payday lenders at the expense of defendants.

Utah has moved aggressively into online dispute resolution, with a confusing system that then punishes people who fail to use it properly. Other states have adopted online dispute resolution systems as a voluntary option, but in Utah, if a defendant doesn’t log in to the online dispute resolution system within 14 days of receiving a written notice in the mail, the court can issue a default judgment against them—an outcome that can lead to garnished wages, hundreds of dollars in court fees, and ruined credit scores.

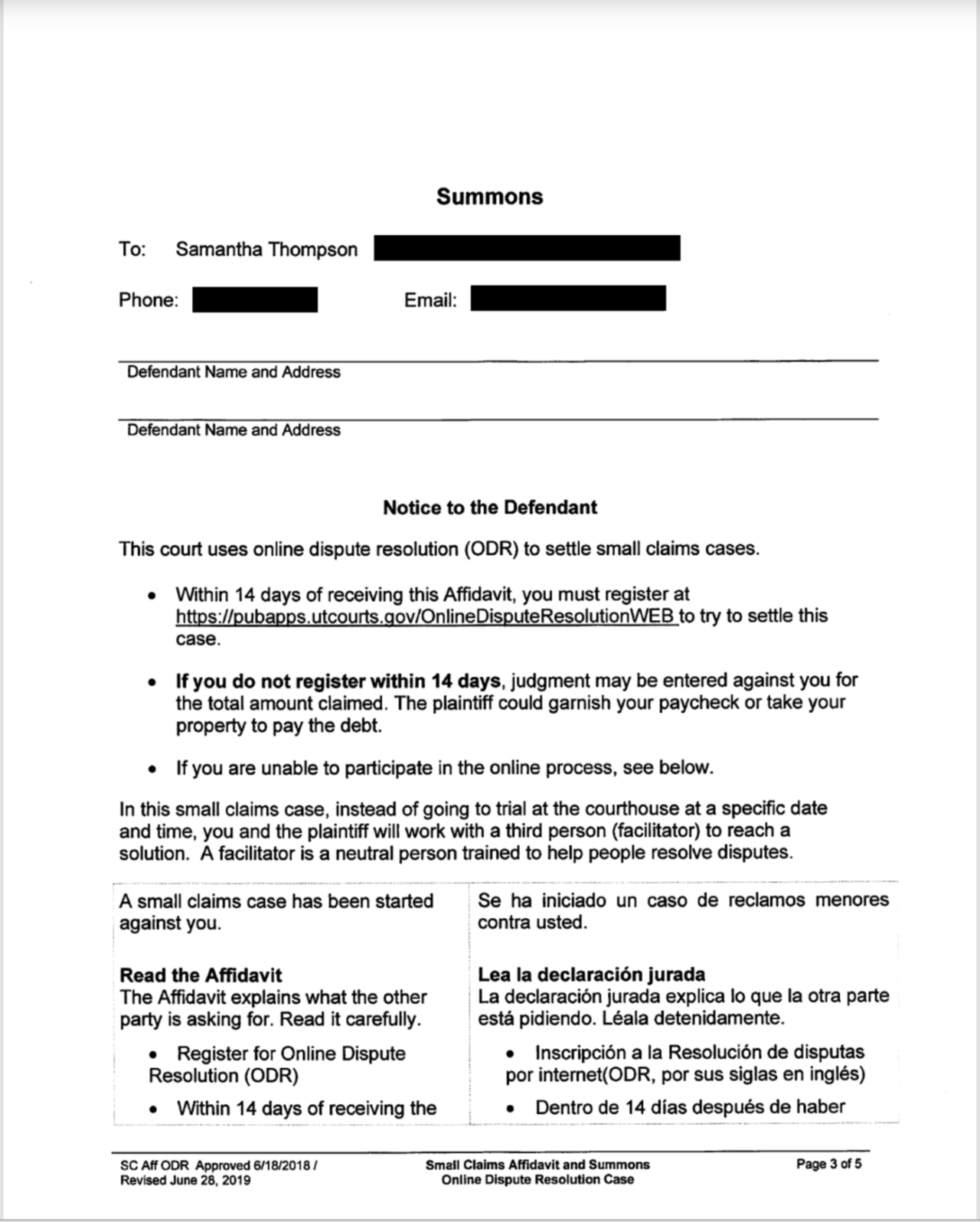

Utah’s system is not easy to navigate. Todd interviewed Utah resident Samantha Thompson, who didn’t notice the case-sensitive, 55-character web address for the online dispute resolution system that was on the third page of a five-page printed mailing she received.

“To me, it was a shock,” Thompson said when The Markup told her about online dispute resolution. “I didn’t even know that kind of system existed.”

Because she didn’t log in to the system, the court issued a default judgment against Thompson and began garnishing her wages. She also had to pay $324 in court fees to the payday lender, Action Rent to Own, in addition to the $671.42 original loan and interest.

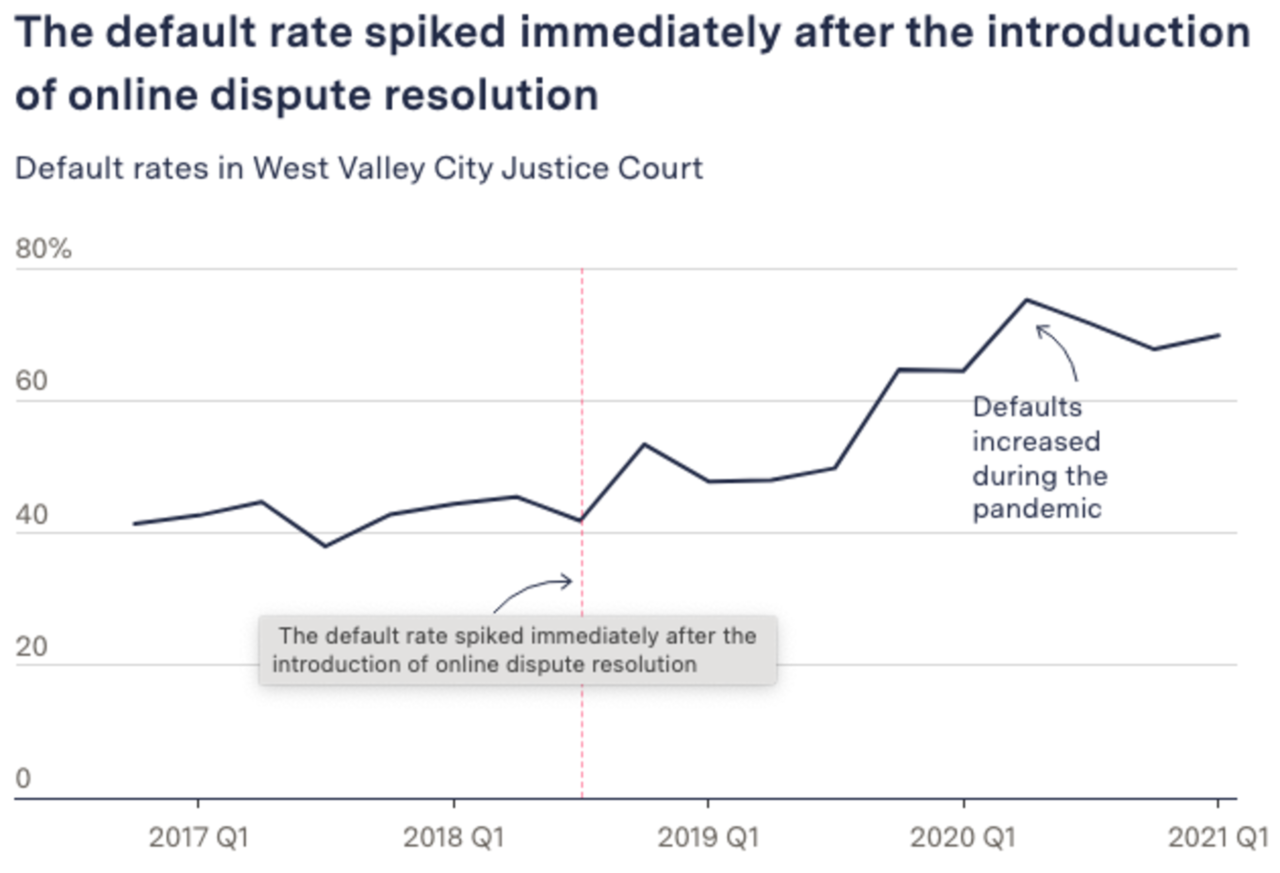

Her case was not unique. Todd analyzed all of the small claims resolutions in Utah’s West Valley City Justice Court, the site of Thompson’s case, and found that the rate of default judgments increased to 59 percent from about 43 percent after the introduction of online dispute resolution in September 2018. That translated to hundreds of additional default judgements over a two-and-a-half-year period.

The winners of these default judgments were primarily payday lenders rather than individual plaintiffs, who also file in small claims court. For institutional plaintiffs, the default rate rose from 46 to 62 percent of cases after the new system was put in place.

Five payday lenders—Money 4 You, Mr Money, Tosh Inc. (which does business as Check City), Dollar Loan Center, and Action Rent to Own—accounted for 83 percent of all cases filed in West Valley City Justice Court during the time period analyzed.

Utah has one of the highest typical annual interest rates for payday loans—652 percent—in the nation. In 16 states payday loans are illegal because their extremely high interest rates violate anti-usury laws.

The payday lender Action Rent to Own told Todd that the convenience of online dispute resolution benefits defendants. “They don’t have to miss work, they don’t have to find a sitter, they can take a lunch break and hop on the phone for 10 to 15 minutes” to negotiate their case, Misti Brunelle, the owner of Action Rent to Own, said. “I feel like it’s more in favor of the defendant.”

Indeed, the convenience of online dispute resolution has led advocates to call it “pajama court” because defendants don’t even have to get out of bed to use it.

But even a pajama court needs to be fair to its users. And a system that sends out a printed URL on the third page of a five-page mailing and then punishes people who don’t find their way to the online system is the opposite of user-friendly.

Researchers at the University of Arizona who studied Utah’s system found that it took users nearly two minutes to type in the URL and that more than one-third of users attempted to enter it correctly more than three times. They recommended creating a shorter URL and QR code that users can scan, as well as putting the links on the first page of the mailing.

Earlier this year, Utah courts adopted the shorter URL and QR code but kept them on the third page of a five-page mailing.

Maybe it’s possible that justice could be meted out better in a chatroom than in real life, but the first step toward justice has to be getting appropriate instructions on how to find your way to the courtroom.

As always, thanks for reading.

Best,

Julia Angwin

The Markup